It's back! Get up to a 2% cash-back bonus on your investments.

Take advantage of this opportunity and boost your investments. Simply deposit and invest a minimum of $1,000 in New Funds* to receive a cash-back bonus. Offer valid from August 15, 2024 to September 30, 2024.

Cash-back bonus tiers

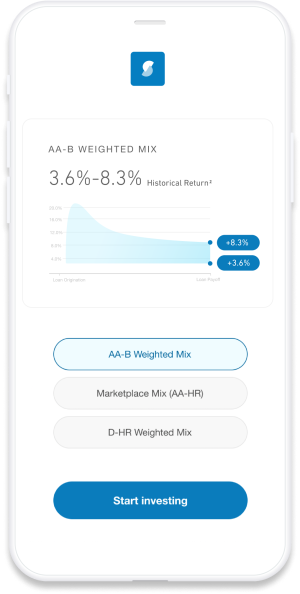

Invest in loans,

diversify your portfolio

- Average historical return of 5.5%¹

- Average 3 year rolling return of 5.9%²

- Over $26B invested since 2005

- Earn passive income as borrowers make monthly payments

Support when you need it

We’re here to help you every step of the way. Reach out with any questions.

- 877-646-5922

- [email protected]

All Notes offered by Prospectus.

Offer Terms and Conditions

The offer period for this promotional offer starts on August 15, 2024 at 12:00am (PST), and ends on September 30, 2024 at 11:59pm (PST) (the “Promotional Period”).

For purposes of this offer, “New Funds” means the amount of net increase in the Available Cash in an eligible Prosper account (as displayed on the Summary account page of your Prosper account) resulting from the deposit (in one or more deposits) of funds from an external source, such as a contribution, direct transfer, or rollover from an IRA custodian, less any withdrawals of Available Cash, as measured on August 15, 2024 at 12:00am (PST) and October 1, 2024 (PST) at 12:00am (PST). “New Funds” do not include any amounts of principal and interest received on Notes held in the eligible Prosper account during the Promotional Period. Any funds transferred out of the eligible Prosper account during the Promotional Period will result in an equivalent reduction in the Prosper account’s total amount of “New Funds” for purposes of determining the qualification for and amount of the bonus.

To qualify for the 1.0% cash back offer, New Funds in the amount of $1,000 or more must be invested during the Promotional Period. To qualify for the 1.5% cash back offer, New Funds in the amount of $5,000 or more must be invested during the Promotional Period. To qualify for the 2.0% cash back offer, New Funds in the amount of $10,000 or more must be invested during the Promotional Period.

This offer is account specific and non-transferrable. One bonus offer per account. Account balances existing prior to 12:00am (PST) on August 15, 2024 will not be considered in determining qualification for and the amount of any bonus described in this offer

Bonuses and account credits may be subject to U.S. withholding taxes and any taxes related to the bonus or credit are your responsibility. Prosper does not provide investment advice, and the information presented here is not intended to be investment, tax, or legal advice. You should consult your tax professional regarding limits on contributions, depositing and rolling over qualified funds, and to determine whether an IRA may be the right choice for you. This offer may be changed or discontinued at any time without notice.

Offer Reference Code: Cash Bonus Offer (Summer 24)

Footnotes

Other Important Information

Prosper’s borrower payment dependent notes (“Notes”) are offered pursuant to a Prospectus filed with the SEC. Notes are not guaranteed or FDIC insured, and investors may lose some or all of the principal invested. Investors should carefully consider these and other risks and uncertainties before investing. This and other information can be found in the Prospectus. Investors should consult their financial advisor if they have any questions or need additional information.

Prosper Funding LLC

221 Main Street, Suite 300 | San Francisco, CA 94105

Contact Us | Terms of Use and Electronic Consent

© 2005-2024 Prosper Funding LLC. All rights reserved.