If you’re planning to make a major home improvement or looking for a smart way to cover a large expense, you have several options for borrowing money. A home equity line of credit, or HELOC, may be a good fit for you.

Here are 7 things you need to know about HELOCs and how they work.

In This Article

What Is a HELOC?

HELOC stands for Home Equity Line of Credit or simply Home Equity Line.

HELOCs allow you to borrow money against the equity you’ve built in your home. Your home’s equity is the difference between the value of your home and your mortgage balance.

Many homeowners opt for a HELOC because they are often given lower interest rates than other types of loans, such as a personal loan, which is unsecured.

With a HELOC, it’s critical to understand that in exchange for the lower rate, your home acts as collateral for the line of credit. This is also known as a “secured” loan. If you are unable to pay back the principal and interest on the HELOC, the lender has the right to pursue foreclosure proceedings—which means you could lose your home.

How Does a HELOC Work?

A home equity line of credit works similarly to a credit card in the sense that you have the option to borrow money over time up to a set credit limit. It serves as a revolving line of credit, giving you access to a cash pool you can borrow from often, rather than borrowing a fixed amount in one instance. Then, you pay back the borrowed amount over time, plus interest.

If you have a credit card, you’re already familiar with the general concept: Credit cards are a widely used form of revolving debt. However, unlike a HELOC, your ability to borrow using a credit card does not terminate after a certain time period. With HELOCs, there is a defined draw period from which you can borrow. That will be outlined in your HELOC term. The average draw period is from 5 to 10 years.

Once your loan has closed, the lender will typically give you special checks or a specific debit or credit card. Many lenders have withdrawal requirements, such as a minimum withdrawal amount or an initial withdrawal maximum.

What Is a HELOC Loan Used For?

Home improvements are the #1 reason homeowners take out a home equity line of credit. You can use the funds to build your dream kitchen, remodel a bathroom, or make outdoor renovations.

Considering the value of your home increases as you make renovations, a HELOC may help you gain a positive return on investment in the long run if you plan to sell your home.

However, HELOCs are not limited to just real estate-related transactions. Although your home is used as collateral, you can use a HELOC to consolidate loans or finance a large expense like a wedding, vacation, or car.

How Much Can You Borrow?

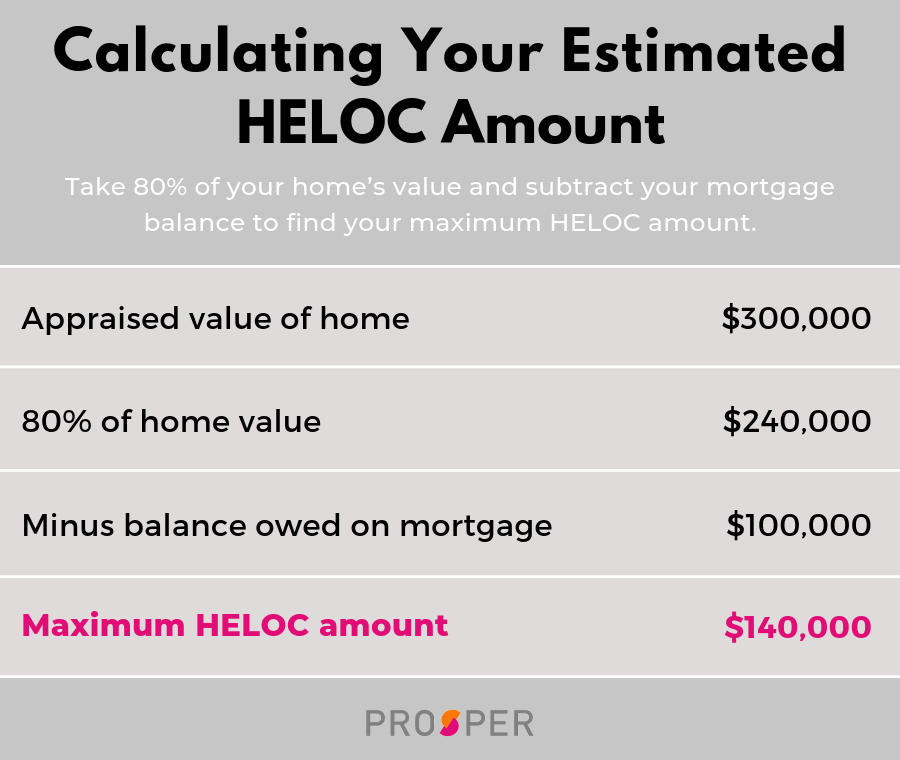

One of the ways your credit limit is typically established is by taking a percentage of your home’s appraised value and subtracting the balance owed on an existing mortgage. You can estimate how much equity you can access with a HELOC calculator.

Lenders also consider your ability to repay by looking at your credit history, income, and other debts and financial obligations, which typically means you need a debt-to-income ratio of 50% or better and a FICO score above 660.

HELOC Calculation Example

Let’s say your home is worth $300,000 and you have a balance of $100,000 on your current mortgage. A lender typically allows you to access a maximum of 80% of the home’s value, less your current mortgage balance. Using that model, here’s an example of how much you could potentially borrow with a HELOC based on these values:

How Much Does a HELOC Cost?

As with nearly all credit products, you’ll pay interest on any amount you borrow. Because your home is “securing” the line, interest rates for home equity lines of credit are often lower than for unsecured loans. HELOCs generally have variable interest rates, which means they can go up or down over time according to a benchmark rate. Some lines also come with:

- An interest rate cap (maximum) and

- A floor (minimum), or

- A “hybrid” option which allows you to lock in a fixed interest rate for a certain period of time.

You’ll also likely have to pay other fees to take out a HELOC, so be sure to check with your lender. The Consumer Financial Protection Bureau has a helpful worksheet that can help you examine and compare the costs of a home equity line of credit.

Depending on your financial situation, a HELOC could be a great option to meet your needs. As with all financial products, be sure that you understand all terms and conditions before taking out a HELOC.

How Do You Pay Back a HELOC?

Depending on the terms of the HELOC, there are usually two repayment options during the draw period:

- Option 1: Pay only interest on the balance that you have borrowed. You can borrow funds up to the established limit.

- Option 2: Pay back the amount you borrowed (the principal) as well as interest owed. As you pay off the principal, you can access more credit, just like with a credit card. Returning to our example above with a $140,000 credit limit: If you withdraw $10,000, your available credit is now $130,000. If you pay $5,000 toward the principal during the draw period, you would now have $135,000 in available credit. Note that you would be responsible for monthly payments of the accrued interest on the $10,000 that you withdrew according to the terms of the HELOC.

Once the draw period ends and you can no longer withdraw money, you enter the repayment period–which typically lasts about 10-20 years.

During the repayment period, you begin paying back both the amount you borrowed and interest. If you were making interest-only payments during the draw period, your monthly payment during the repayment phase is likely to be significantly larger.

Some HELOCs may offer the ability to have a fixed monthly payment during the repayment period. Under these programs, you may be required to make a sizable “balloon” payment at the end of the repayment period if the fixed monthly payment is not sufficient to repay the entire outstanding principal and interest.

How Does a HELOC Differ from Other Loan Options?

HELOC vs. Credit Cards

As stated previously, home equity lines of credit and credit cards both offer a revolving line of credit. This makes both options useful for ongoing expenses in your day-to-day lives. The difference? HELOCs usually offer interest rates that are much lower than credit cards. In fact, some borrowers actually apply for a HELOC to consolidate their credit card debt.

Home Equity Line of Credit vs. Home Equity Loan

Sometimes a HELOC can get confused with a home equity loan. A home equity line of credit and home equity loan are both secured by your house–which means both options usually offer lower interest rates.

But here is the difference: A home equity loan is a lump sum cash deposit that you have to start paying back immediately. A home equity line of credit, on the other hand, offers you a line of credit that allows you to borrow as you need. Therefore a HELOC is more flexible and you don’t have to take the whole amount you are approved for at once.

HELOCs vs. Personal Loans

Many people are often stuck when deciding between a HELOC or a personal loan, which is another popular borrowing option. Both HELOCs and personal loans involve borrowing a set amount of money over time and then paying it back with interest.

The main difference is that HELOCs typically have variable interest rates, meaning the rate can change over time. Personal loans usually have fixed interest rates that are locked in from the beginning of your loan. Plus, personal loans and other online loans often do not require collateral, as HELOCs do with your home.

However, home equity lines of credits typically have lower interest rates than personal loans since you’re using your home as collateral. Plus, using a HELOC toward home improvements could help you increase your home’s value as you renovate it, possibly giving you a better bang for your buck if you are able to sell later on.

It’s important to explore your options and talk to a lender about which financial product is best for you. Your decision may be based on how quickly you need the cash, how you’d like to receive the money, or whether you’d like to use your home as collateral. The decision will differ based on your individual needs.

Eligibility for a home equity loan or HELOC up to the maximum amount shown depends on the information provided in the home equity application. Depending on the lender, loans above $250,000 may require an in-home appraisal and title insurance. Depending on the lender, HELOC borrowers must take an initial draw of the greater of $50,000 or 50% of the total line amount at closing, except in Texas, where the minimum initial draw at closing is $60,000; subsequent HELOC draws are prohibited during the first 90 days following closing; after the first 90 days following closing, subsequent HELOC draws must be $1,000, or more, except in Texas, where the minimum subsequent draw amount is $4,000.

The amount of time it takes to get funds varies. It is measured from the time the lender receives all documents requested from the applicant and depends on the time it takes to verify information provided in the application. The time period calculation to get funds is based on the first 4 months of 2023 loan fundings, assumes the funds are wired, excludes weekends, and excludes the government-mandated disclosure waiting period.

For Texas home equity products through Prosper, funds cannot be used to pay (in part or in full) non-homestead debt at account opening.

Depending on the lender, qualified home equity applicants may borrow up to 80% – 95% of their primary home’s value and up to 80% – 90% of the value of a second home. In Texas, qualified applicants may borrow up to 80% of their home’s value. HELoan applicants may borrow up to 85% of the value of an investment property (not available for HELOCs).

Home equity products through Prosper may not be available in all states.

All home equity products are underwritten and issued by Prosper’s Lending Partners. Please see your agreement for details.

Prosper Marketplace, Inc. NMLS# 111473

Licensing & Disclosures | NMLS Consumer Access