- Taylor got an offer!

$120,000 Loan amount $950 Monthly payment²

See your home equity loan rate and maximum loan amount, with no impact to your credit score.

Customize your HELoan offer and finish your online application in minutes.

Quick closing and your HELoan funds accessible in as few as 11 days.

A home equity loan through Prosper uses up to 90%1 of your home equity to access up to $249k* at a low, fixed rate with 5–30 year2 term options.

From home improvements and major purchases to debt consolidation, family expenses, and everything in between.

Visit the Prosper Help Center for more answered questions

A home equity loan (HELoan) is a loan that typically has a fixed interest rate and is disbursed in a lump sum at the beginning of the loan.

It’s a bit like a second mortgage: you’ll start repaying it immediately through fixed monthly payments. HELoans are secured by your house. This allows you to access larger sums of money at lower rates.

A HELoan is a loan with a fixed rate and fixed monthly payments. It is secured by your home, much like a second mortgage.

Lenders will determine how much you may borrow by considering the amount of equity in your home, your credit score, and your debt to income ratio. A HELoan is disbursed in one lump sum, and you’ll make fixed monthly payments for the duration of your loan.

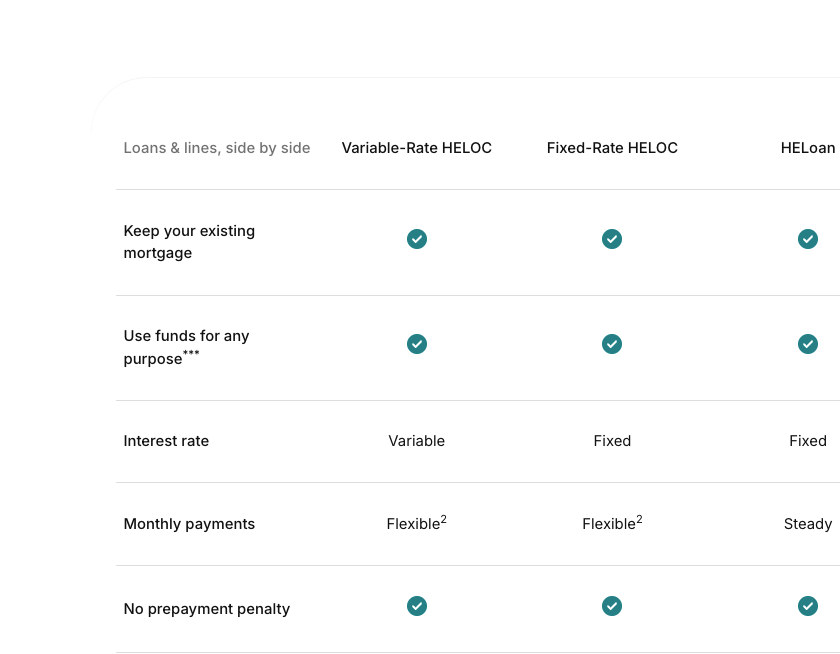

A HELOC is a revolving line of credit that typically has a variable interest rate. A HELoan is a fixed rate, fixed term loan.

A HELOC is a revolving line of credit that lets you draw against your credit limit as you need to access funds*. Like a credit card, you can borrow and repay up to the credit limit during the draw period. On the other hand, a HELoan is paid out in a one-time disbursement, and you’ll start repaying on the full balance immediately through fixed monthly payments. Ultimately, a HELOC is more flexible while a HELoan is more structured.

For more information on the differences between a HELOC and a HELoan and how you might choose if one of them is the best option for you, visit Prosper’s popular blog article that breaks it all down: HELOC vs HELoan: What’s the difference?

In some cases, home equity loan interest may be deductible, but it’s critical to note that this is a complex issue, so you should talk to a tax professional and check with IRS guidelines before making a decision.

If you have built up equity in your home and you’re looking to finance a specific major expense, then a HELoan could be a great fit for you.

The fact that it’s secured by your home allows you to access a larger total amount at a lower interest rate—and unlike a HELOC, which typically carries a variable interest rate, a HELoan usually comes with a fixed interest rate. This means zero surprises when it comes to your monthly payments, and no temptation to spend beyond your budget.

In most cases, borrowers can choose the term that best suits their needs, with terms up to 30 years.

In general, the longer the term, the lower the monthly payment. On the other hand, shorter terms typically come with lower annual percentage rates (APRs).

We’ve got your back, every step of the way.

Home equity is just the beginning. Prosper has smart, simple tools for borrowing, saving, and earning with products like personal loans, a credit card, and investing.

2 For example, a twenty-year $60,000 HELoan could have an interest rate of 7.525% and typical costs, fees or charges of $2,112 for an annual percentage rate (APR) of 8.002%. You could receive $57,888 and make 240 scheduled monthly payments of $484.27.