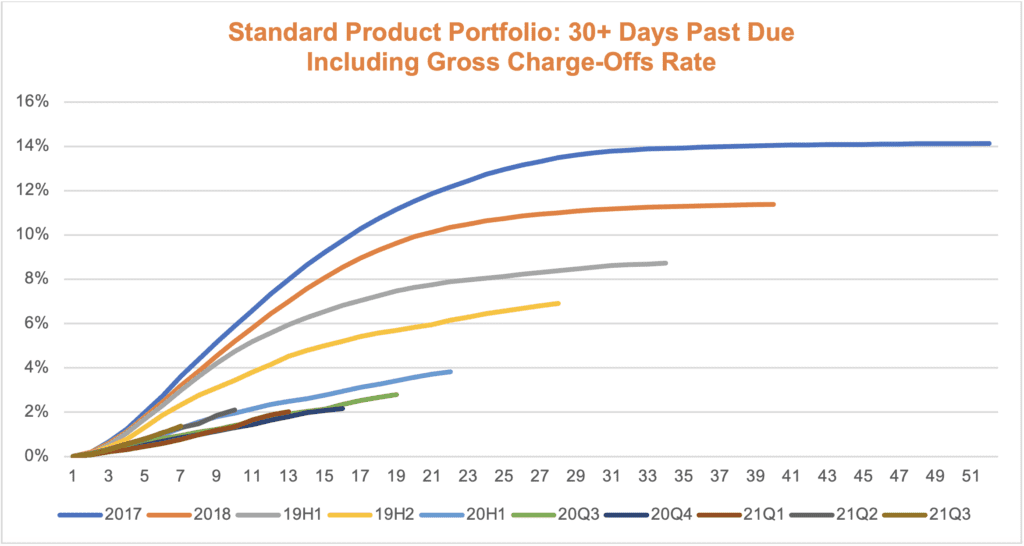

Prosper’s latest investor update highlights the performance of standard product loans (“Standard Product”) originated through the Prosper platform. Delinquencies for the latest origination vintages (2021Q1 – Q3) remain significantly lower than pre-pandemic vintages used to set credit performance benchmarks, reflecting Prosper’s disciplined and long-term approach to risk management.

Our strong credit performance is enabled by innovative risk strategies combined with machine learning models that leverage proprietary data from over one million borrowers across the Prosper platform, along with data from credit bureaus and alternative sources.

Current Macro Economic Environment

Though persistently high inflation and Fed policy remain a significant headwind in 2022 amid supply chain disruptions, labor shortages, geopolitical conflicts, and the emergence of new COVID-19 variants, we believe the financial health of most US consumers remains resilient.

Multiple Fed rate increases are expected in the coming months to combat inflation. However, these rate increases are also expected to drive credit card balance growth and slow credit card payment rates, boosting personal loan demand.

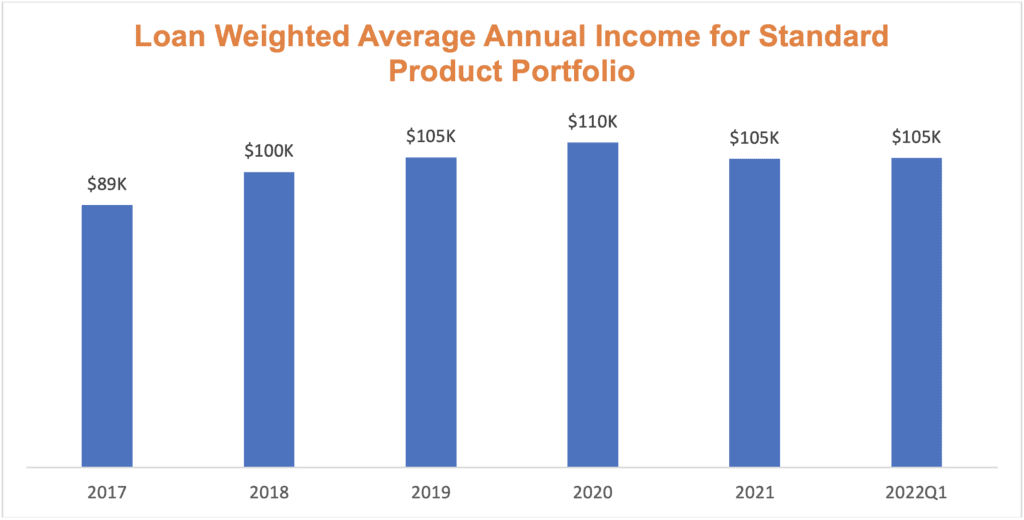

Tailwinds supporting consumers’ ability-to-pay include robust wage growth, record household wealth, and low unemployment rates. Therefore, although credit normalization is occurring across nearly all risk segments, we expect the performance of prime consumer segments, which comprise most of the standard product loans originated through Prosper’s platform, to remain healthy.

Current Trends

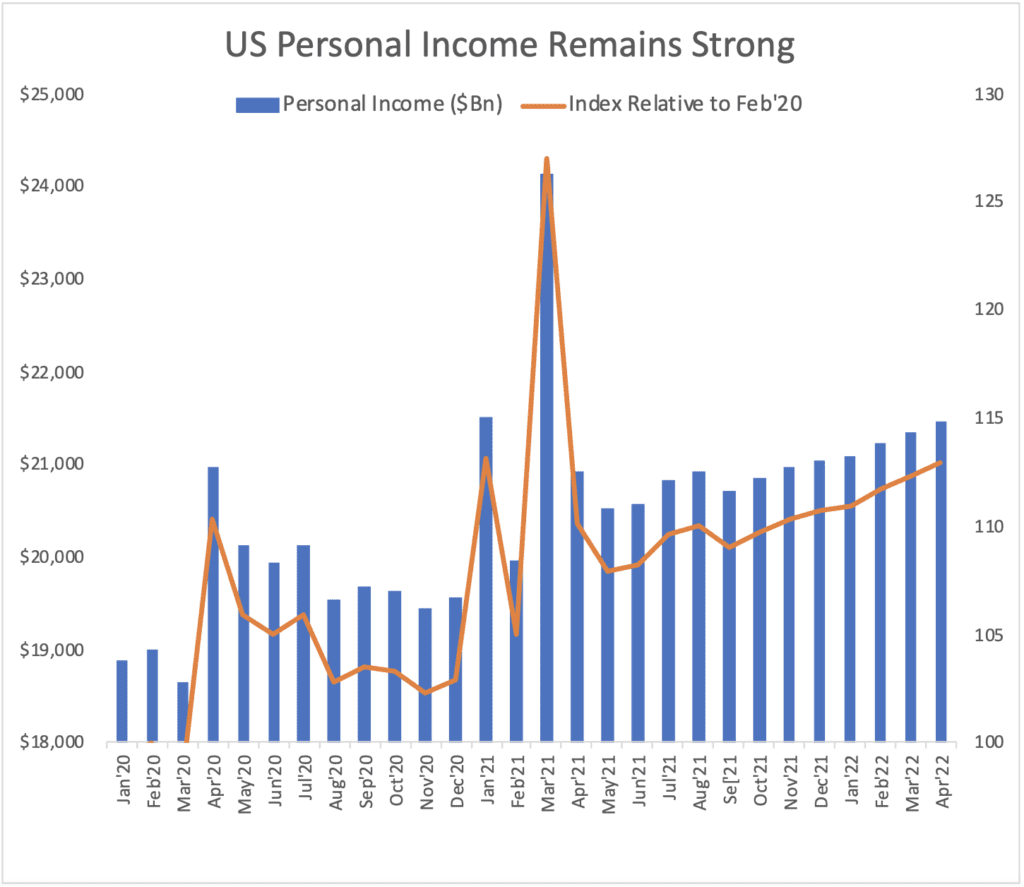

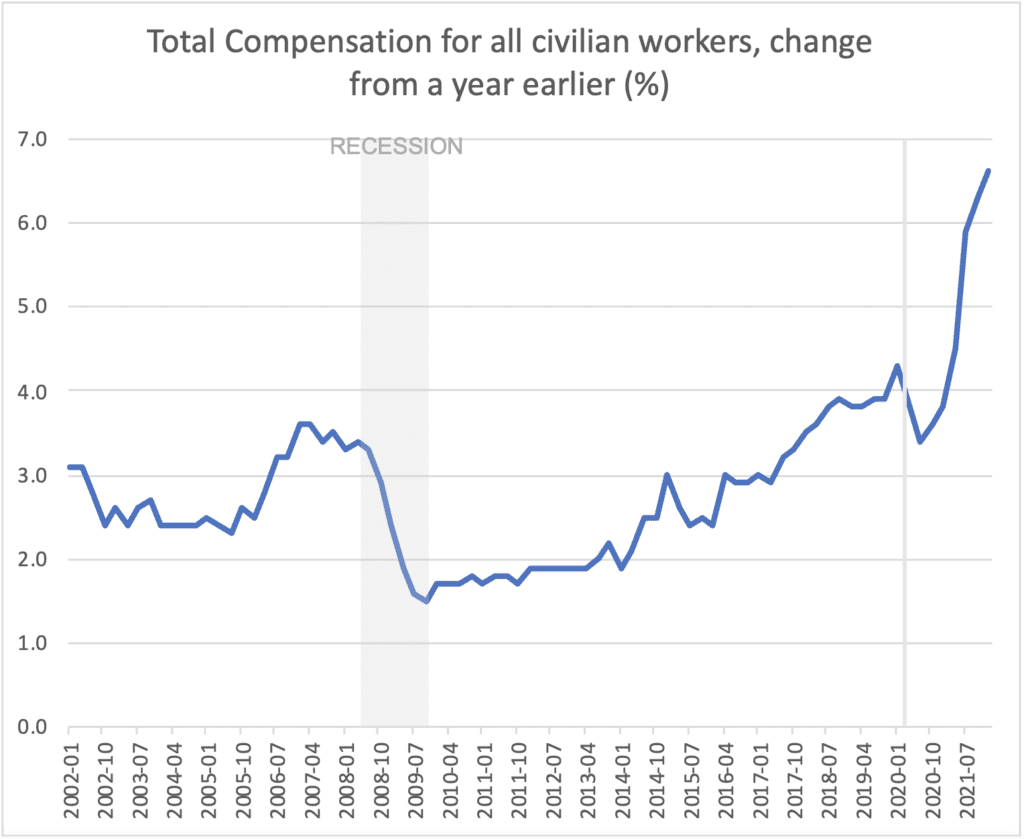

- US household income remains strong. Compared to February 2020, total personal income increased by $2.3T (~12%), mainly driven by wage growth. Year-over-year growth in workers’ pay and benefits reached a record high of 4.5% in 2022. [1] [2]

- The US unemployment rate is back to pre-pandemic levels as of May 2022. The number of job openings per unemployed reached a record of 2. [3]

- Driven by increased consumer spending and strong new credit card originations, bank card balances rebounded by 14% year-over-year to $868B in May 2022, higher than the February 2020 level of $855B. High inflation and pent-up spending on services may further accelerate balance growth. [4][5]

- Personal savings rate dropped to 4.4% in April 2022 as consumers utilize savings to address persistently high inflation. This significant decline in the savings rate will lead to higher loan demand, lower payment rates, and increasing delinquency rates as the path to credit normalization continues. [6]

- In the unsecured personal loan sector, delinquency rates are trending back to pre-pandemic levels which can be attributed to the increasing mix of non-prime loans and fading impact of government stimulus. [5]

Performance of Prosper Standard Product Loans

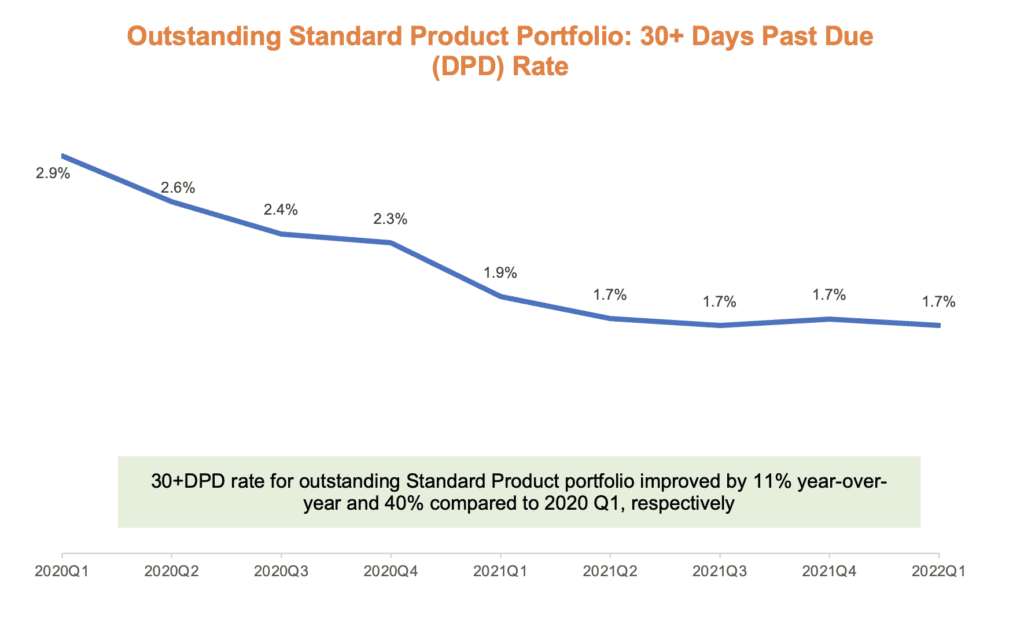

Overall performance of Prosper’s outstanding Standard Product portfolio remains robust and is trending 40% better than pre-pandemic levels.

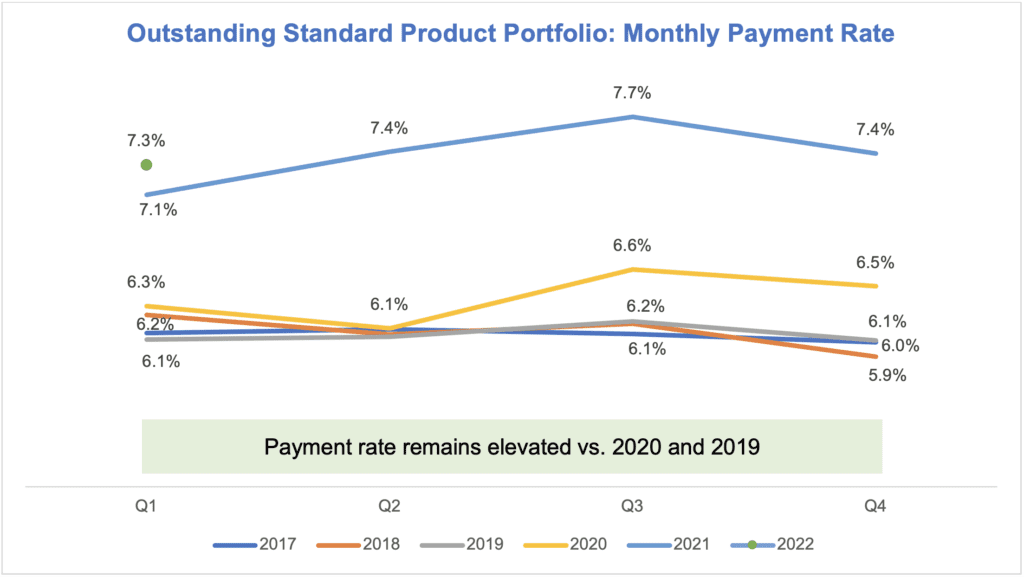

- 30+ Days Past Due (DPD) rate for Prosper’s Standard Product portfolio improved 11% year-over-year and is 40% favorable compared to pre-pandemic levels. In addition, the monthly payment rate in March 2022 for the Standard Product portfolio was 18% higher than pre-pandemic levels

- As of May 2022, 0.7% of the outstanding balance of the Standard Product loans was enrolled in a COVID-19 payment relief plan

- Performance of Standard Product borrowers who did not enroll in any hardship program continues to trend favorably, with a 30+ DPD rate that is over 60% lower relative to pre-pandemic levels

New Originations Credit Quality and Early Performance

- We launched our new machine learning underwriting model and risk strategies in June 2021. Early credit performance of H2 2021 vintages is significantly better than pre-pandemic vintages

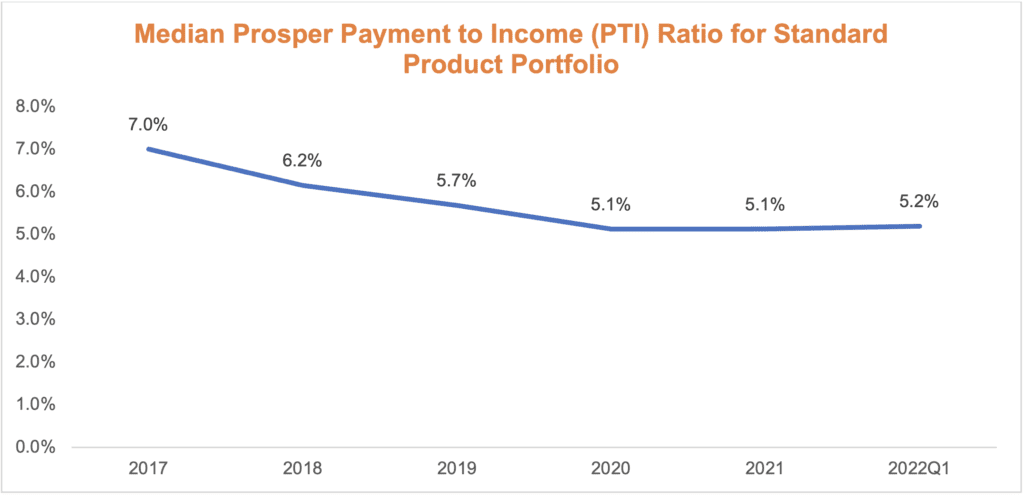

- Median monthly loan payment to income ratio (PTI) was 5.26% in Q1 2022 vs. 5.33% in Q1 2020

- We believe our emphasis on long-term sustainability is a key differentiator of credit performance on the Prosper platform. Despite significant uncertainty in the current macro-economic environment, Prosper remains highly disciplined in our approach and continues to prioritize attractive risk-adjusted returns for investors

[1] https://fred.stlouisfed.org/series/PI

[2] Labor Department via St. Louis Fed

[3] https://fred.stlouisfed.org/series/UNRATE

[4] https://fred.stlouisfed.org/series/CCLACBW027NBOG

[5] Transunion US consumer credit database

[6] https://fred.stlouisfed.org/series/PSAVERT

This article includes forward-looking statements. Forward-looking statements may include financial and other projections, statements about growth opportunities, statements regarding future results, plans, or events, as well as the assumptions underlying any of the foregoing. Forward-looking statements inherently involve many risks and uncertainties that could cause actual results to differ materially from those projected in these statements. Although forward-looking statements contained in this article are based upon what we or management of the Company believe are reasonable assumptions, there can be no assurance that the expectation or belief will result or be achieved or accomplished. All forward-looking statements speak only as of the date of this article and are expressly qualified in their entirety by the foregoing cautionary statements. We undertake no obligation to update or revise forward-looking statements that may be made in this article to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

Prosper’s borrower payment dependent notes are offered pursuant to a Prospectus filed with the SEC. All data in this article is presented for informational use only. This data is impersonal and is not directed to the specific investment objectives, financial situation or investment needs of any particular person, and should not be considered investment advice. This information is not intended to be, nor should you interpret it to be, a prediction of how any particular portfolio will actually perform.